The Convergence of XRP and Cardano: Pioneering a New Era in Decentralized Finance

Setting the Stage for Blockchain Synergy

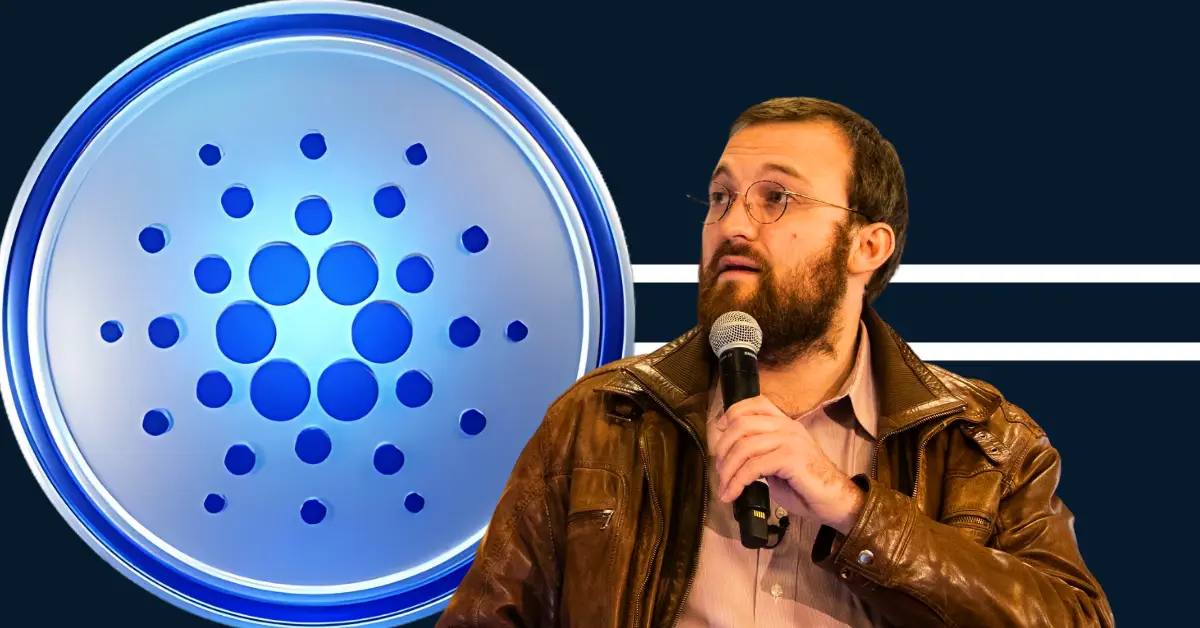

The fusion of Ripple’s XRP and stablecoin RLUSD with Cardano’s blockchain ecosystem signifies a landmark shift in decentralized finance (DeFi). At the confluence of two substantial blockchain forces, this collaboration, driven by Cardano’s founder Charles Hoskinson, promises to enrich DeFi functionalities and foster unprecedented interoperability. By threading Ripple’s liquidity and stablecoin capabilities into Cardano’s proof-of-stake framework, the partnership introduces promising dynamics that could reshape user experience, liquidity flow, and ecosystem growth in the crypto landscape.

Cardano’s Strategic Leap with the “XRP Package”

The core ambition centers on the rollout of what is described as the “XRP package”: a blend of XRP-based DeFi tools, native RLUSD stablecoin support, and streamlined integration with Cardano’s official wallet, Lace. This package aims to expand Cardano’s financial services offerings beyond ADA, bringing XRP’s established network and assets under Cardano’s scalability umbrella.

Hoskinson’s consistent messaging across multiple media formats reveals a purposeful strategy, though without a rigid timeline, emphasizing foundational groundwork before full deployment — a sign of careful engineering behind this ambitious endeavor.

Key Components Unpacked

XRP DeFi Integration: Expanding Financial Possibilities

Integrating XRP into Cardano’s DeFi toolkit introduces familiar yet innovative financial services such as lending and borrowing centered on XRP’s liquidity. This integration is designed to complement rather than compete with Cardano’s native ADA ecosystem, offering expanded yield opportunities and attracting both seasoned DeFi participants and new users from Ripple’s extensive base.

By enabling native XRP transactions within Cardano, developers and investors can explore hybrid applications that harness strengths from both networks, potentially sparking new product innovations and liquidity scenarios.

RLUSD Stablecoin: Accelerating Stable, Scalable Transactions

RLUSD, Ripple’s fiat-backed stablecoin already active on Ethereum and the XRP Ledger, stands to benefit from Cardano’s high-throughput, energy-efficient consensus mechanism. Making RLUSD accessible on Cardano could lead to faster, more secure stablecoin transactions, unlocking new DeFi products that emphasize price stability and scalability.

This opens pathways for Cardano-based payment rails, lending markets, and decentralized applications (dApps) that leverage stable value transfer, enhancing confidence for institutional and retail participants alike.

Lace Wallet and Glacier Drops: Enhancing User Interaction

Cardano’s Lace wallet will evolve to natively support XRP and RLUSD assets, enabling users to easily store, send, and interact with these cryptocurrencies alongside ADA. This integration eliminates friction points by consolidating multiple assets within a single, user-friendly interface.

Furthermore, the introduction of “glacier drops” hints at innovative distribution or staking incentives designed to reward participant engagement. While details remain sparse, these mechanisms could drive liquidity inflows and community participation, acting as a catalyst for adoption.

Midnight DeFi Layer: A Dedicated Infrastructure for XRP

The concept of the “Midnight” DeFi layer represents a specialized infrastructure extension within Cardano tailored to serve XRP’s ecosystem. This layer might empower XRP holders with decentralized governance tools and yield optimization strategies native to Cardano—retaining the unique characteristics of XRP while embedding it into Cardano’s scalable DeFi environment.

Such a dual-layer approach respects existing XRP identity while opening new avenues for interaction and value creation.

Broader Implications for Cardano and the Crypto Community

This alliance transcends simple asset porting: it reflects a strategic alignment aimed at generating synergistic value. By incorporating Ripple’s assets, Cardano enriches its liquidity ecosystem and diversifies its financial products, enhancing appeal to institutional investors and developers.

Potential outcomes include:

– Enhanced Innovation: The merging of Cardano’s infrastructure with Ripple’s asset ecosystem may inspire novel financial instruments and drive broader adoption.

– Ecosystem Expansion: With Ripple’s vast user base (approximately 37 million), this integration lays groundwork for onboarding new participants via mechanisms like token airdrops.

– Financial Scale-up: The announcement of a $100 million ADA infusion dedicated to DeFi projects underscores a commitment to resource-backed ecosystem growth.

– Interoperability Advancement: This collaboration exemplifies the shift towards interconnected blockchains, easing asset movement and composability, thereby reducing ecosystem silos.

Navigating the Challenges Ahead

Despite a compelling vision, several hurdles warrant careful consideration:

– Technical Hurdles: Bridging distinct blockchain architectures (UTXO-based Cardano vs Ripple’s consensus model) presents intricate development challenges to preserve security and operational efficiency.

– Regulatory Climate: Ripple’s ongoing legal circumstances could impact momentum and perception, even as Cardano proceeds confidently with collaboration.

– User Adoption: The effectiveness of wallet integrations and real-world utility of new XRP-centric DeFi offerings will be crucial in winning user trust.

– Uncertain Timelines: The absence of precise deployment dates means that market participants must balance optimism with patience.

Looking Ahead: Bridging Vision and Reality

The emerging alliance between Cardano and Ripple through the “XRP package” heralds a bold new chapter for DeFi innovation. Combining Cardano’s scalable ecosystem and environmental advantages with Ripple’s well-established assets and stablecoin promises to redefine how decentralized finance products are developed and accessed.

This partnership models a future where blockchains are less isolated and more interoperable, nurturing diverse financial opportunities and expanding inclusion in the cryptocurrency economy. For users, developers, and institutions, this integration offers a renewed trajectory toward more versatile, efficient, and accessible blockchain finance.

In capturing the collaborative spirit of two blockchain giants, this initiative not only augments the capabilities of each ecosystem individually but also sets a powerful precedent for future cross-chain ventures. The crypto community will keenly observe how this fusion unfolds, as it holds the potential to shape the contours of DeFi’s next evolution.